Google has swiftly changed the retail SERP landscape over the last year with:

- Product results taking up 45% of the SERP composition in Q1 2023.

- Google Search Console (GSC) releasing new KPIs to measure against product result appearance types, to Google refining the way it contextualizes results to ecommerce consumers.

- The list goes on.

But how much weight do all these SERP shift impacts hold? We are here to break down key takeaways from major retail SERP changes, including:

- Why is Google adapting how it serves product results to consumers in 2023.

- New SEO strategies to consider when tackling product-first results.

- Total search practices to optimize toward product-first search cross-channel.

Organic product results’ rise into retail SERP prominence

In Q1 2023, the retail industry’s SERP composition changed faster than ever before with new algorithm updates and product results rising to own more SERP real estate.

Merkle data showed product listing types accounted for nearly 45% of SERP composition in the retail landscape, which is a 20-percentage point increase YoY.

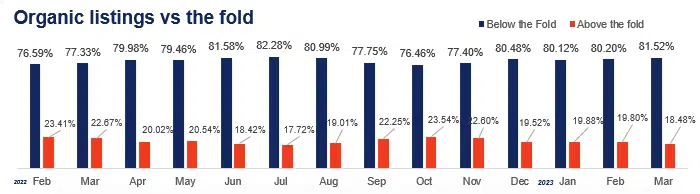

As a result of this composition shift, organic web listings appeared above the fold only 18% of the time, which is a 6% decline YoY, and the overall presence of organic web listings on the SERPs fell 7.6% YoY in Q1 2023.

In April 2023, Google rolled out the reviews update, which followed six product reviews updates since April 2021.

SERP composition shifts aside, now SEOs had to grapple with Google relying less on standard third-party reviews on-site and more on in-depth reviews that illustrate visual evidence of a product or service experience – all without knowing exactly how they’d impact organic product result types within the SERP.

So, what do we make of these product review updates and SERP composition shifts? First, let’s see what else happened.

Why is Google redefining retail SERP composition with product results?

As organic product results and shopping listings increased YoY in Q1 2023, so did rich snippet types, such as People also ask (+7% YoY) and People also search (+10% YoY).

Marrying these takeaways with text ad declines (-42% YoY), we’re more than redefining position 1. We are seeing retail search evolve for the better. Google is changing how it serves organic product results, but why?

Alleviating even more search stress of consumers

We must remind ourselves, what has always been Google’s primary objective for algorithm changes of any kind? Making search better for the user.

Keeping up with Google’s product result repositioning is a lot to digest, comprehend, measure, and optimize against to work in lockstep with these updates.

But shouldn’t we be seeing the good in what Google is trying to do for the average consumer?

Yep, that’s right. Perhaps this is Google’s attempt at alleviating the “search stress” from a consumer who may be bucketed into the following intention types:

Google continues to evolve its algorithm as it learns more about consumers’ shopping behaviors and habits but, in tandem with this, to compete more strongly against other search engines and marketplaces.

Acting as a marketplace via merchant listings + product snippets

Aside from alleviating search stress off consumer plates, Google is trying (very hard) to compete with other prevalent online marketplaces by serving products over organic web listings.

This way, users get a better browse (a.k.a., online window shopping) experience without visiting a website first.

This makes complete sense when looking at Q1 2023. Up to 56% of U.S. consumers begin their search on Amazon over search engines such as Google, Bing, or Yahoo, according to eMarketer.

As a result, it isn’t surprising that product-first results continue to grow in percentage ownership of the retail SERP composition because Google wants to compete more with Amazon and other fast-growing marketplaces like TikTok.

There are new rising competitors to SERPs such as Amazon, TikTok, and YouTube when it comes to online shopping lanes, as eMarketer’s report details.

With a YoY Q1 decline in SERPs as a starting spot for online search, Google’s retail SERP aesthetic changes are in direct response to this.

Thinking more strategically in terms of target consumer behavior, as SEOs, we know that consumers who are:

- Brand loyal will continue to shop with a brand-first mentality but not always converting on the brand’s site.

- Not brand loyal will window-shop to price compare, digest reviews like crazy, and must have full trust in their purchase before converting.

So, what does all this mean for SEOs out there? It means fine-tuning what we’ve already depended on since the dawn of SEO time: content strategy and technical SEO remediation.

Google Search Console April 2023 updates for organic shopping

As product result dominance continued to grow in the SERP composition, in March 2023, Google finally added monitoring updates in GSC performance reporting.

This update changed the single attribution of “product results” in GSC to two separate breakouts: “product snippets” and “merchant listings.”

So, what’s the difference?

- Product snippets: Organic web listings of PDP URLs with a snippet or extension of the product’s URL, title, and description that include additional unique elements such as reviews, ratings, shipping and return polices, price, and location-based availability.

- Merchant listings: Unpaid and organic display of Google Shopping product listings, often seen within a carousel as a top result in the SERP, above organic web listings. These results used to have the “Popular Products” label above the feature in the SERP. Merchant listings can also be found in the Shopping tab of Google Search.

- Google Shopping Results Tab: Once solely reserved for PLAs (product listing ads), the shopping results tab now showcases paid and organic product listings. These results are reported via Google Ads for PLAs and in GSC for unpaid product listing result types, such as product snippets and merchant listings.

Though the new product result type data in GSC is fragmented and still picking up speed as a KPI, Google is, at last, giving retail search marketers the ability to pull together a landscape, albeit not as clear as we would like, of how our brand’s products are displayed.

Get the daily newsletter search marketers rely on.

SEO strategies for product results in retail SERPs

Just because Google has shifted contextualizing product results in retail SERPs doesn’t mean SEOs must create new competencies to counteract this change.

Rather, core SEO tactics to influence product results in the SERP remain the same, just applied in a new environment:

- Implement product schema refinements to align with rich SERP composition updates, such as shipping and return policies.

- Mitigate the risk of high bounce rate or lost traffic with an out-of-stock (OOS) handling strategy.

- Ensure robust and unique content with a strong product description page (PDP) content strategy.

- Understand the impact and overlap of re-seller strategies, where applicable.

- Eliminate PDP site speed hindrances.

For product results in the SERP, we know that users can engage in one of two ways:

- Via product listing ads.

- By organic means, such as product snippets or merchant listings.

This highlights the need for a “total search” lens. Total search is the process of ensuring paid, organic, and shopping activities work more successfully together.

Below are a few considerations to keep in mind for total search:

- Are canonical tags in place for parameterized PDP URLs to ensure that Google attributes organic vs. paid engagement back to the authoritative URL?

- How are organic parameters being managed and created for PDP URLs?

- Within additional field details, can the SEO team support keyword enhancements to influence organic product listing types in Google?

- Is structured data pulling into Google Merchant Center?

TL;DR: Optimizing for retail SERPs in 2024

Here are key takeaways and next steps to remember when crafting ecommerce SEO strategies through the rest of the year and going into 2024.

Develop a PDP content strategy

Gone are the days when copying and pasting third-party content on SKUs checks the box.

We must advocate for curating unique content on PDP landing pages for Google to crawl, index, and render the difference between a product variation from retailer to the next

Ensure PDP schema is dynamic

As Google continues to take a sharper lens at PDP schema refinement, it’s best to take advantage of all PDP schema fields, making them as lean and dynamic as possible – including but not limited to:

- Regional Pricing

- Shipping

- Returns

- Availability

Collaborate with paid search folks on PLAs

Learning more about the feed served to paid search teams will ensure all PDPs are optimized before being populated into Google Merchant Center every day.

Opinions expressed in this article are those of the guest author and not necessarily Search Engine Land. Staff authors are listed here.

Source link : Searchengineland.com